What is Swing Trading?

Swing trading is a type of trading where a trader buys and sells a stock within a short time, anywhere from a few seconds to a few weeks. The point of swing trading is to make a profit by the price fluctuation of a stock without paying attention to the company fundamental. The ones who are doing swing trading is what we called traders.

How Does Trading Work?

In theory, one trader makes money, another has to lose. For example, if you bought a stock at $2 and it rises to $3, you made $1 per share. If you bought $1000 worth of shares or 500 shares, then you made $500 on this transaction. The person, who sold you the stock at $2 just lost $500 on his trade.

Nobody wants to lose money, therefore you need to have edge over the average traders

in order to make money in trading stocks. The average trader speculates, and doesn't

study the market. Most people are in the stock market looking for a way to get rich quickly.

They listen to tips from gurus or friends and families, and usually these traders

go broke faster than they came in to the market.

It is easy to put on a trade, but making money from trading is another story. In order to trade successfully, one needs to spend time studying and analyzing the market to improve his skills. A doctor or a lawyer spent years in school and prepares for his or her career. A successful trader makes the same amount of as a doctor or a lawyer if not more, so why should anyone expect trading to be easy.

Just like any other profession, one must approach trading as a career or as a business, and not some kind of habit or a way to get rich overnight. It might look easy from the outside, where a beginner sees how a trader makes money from a few mouse clicks. In actuality, successful traders spend hours analyzing the market everyday and prepare for the next trading session.

Stock Chart Patterns & Technical Analysis

To improves the odds of trading success. We need to use something called stock charts and patterns to predict the short term price movements. Successful traders in the 80's used to plot the daily movement of stock price on a chart, so that they can analyze. Nowadays, there are all kinds of stock charting platform out there that you can utilize for free. The first thing we need to learn as a trader is to learn how to read a stock chart.

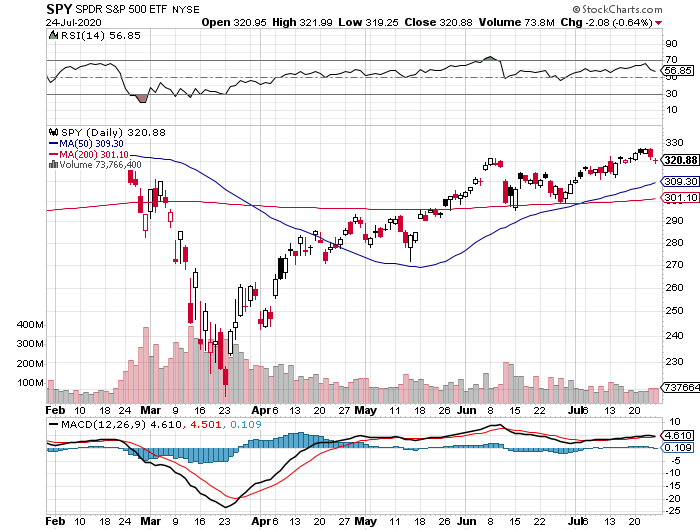

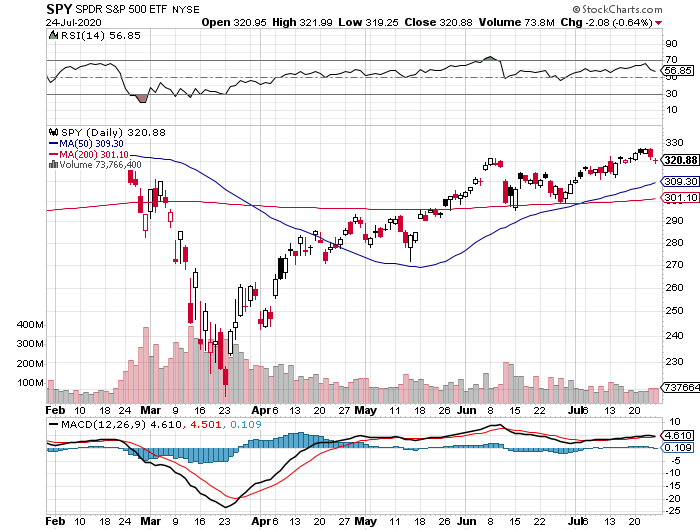

Below is a sample stock chart of SPY, where the daily price and volume is plotted on a candlestick chart. We will go over on a future post on how to read stock charts in more detail.

Once we learn how stock charts work, we can then move on to find profitable chart setups by recognizing top chart patterns and how to apply technical indicators to swing trading. Technical indicators are tools developed by traders to help predicting the short term stock momentum. Most of them are derived directly or indirectly from stock price and volume.

As a technical analysts, we believe if a pattern works in the past, it will continue to work in the future except when it fails from time to time. During those times, we have to cut loss quickly and move on to the next trade.

However, cutting losses is easier say than done. Many times, right after you sell a stock for a loss, you see the stock bounce right back. This gives new traders a false sense that stop loss isn't necessary. The stock may be bouncing back this time, but often it won't. When it doesn't bounce back, it may keep falling and a trader without a stop loss will eventually lose everything. This opens up a new field of study called the trading psychology.

Trading Psychology

Trading psychology is critical in swing trading because it is the only difference between a successful and failing in trading. It is even more important than reading stock charts and interpreting patterns. One may be able to find a winning trading strategy, but if he fails to follow trading rules such as cutting loss, he will ultimately turn the winning strategy into a money losing machine. Fortunately, trading psychology is something that a trader can acquire with experiences if he or she put in the effort. If you are able to cut losses, you are already ahead of 70% of traders.

There are many books written on trading psychology and mental attitude towards trading, the one that I found to be the most useful is Trading in the Zone. In this book, author Mark Douglas taught us not to fall in love with any trading strategy or technical indicator. Anything can happen in the stock market and we need to be prepare for every scenario. This book literally opened up my mind about the market and how not to treat the market like a casino.

Trading vs. Investing

There is a big difference between trading a stock and investing in a stock. In the long term, stocks prices are driven by company fundamentals and the general economy. If someone is buying stocks and holding it for over a year or longer, we called him or her an investor. Investors usually use fundamental analysis to analyze a company and make buying decisions based on the income statements and balance sheets of a company.

There are two types of investor, growth investor and value investor. Growth investors are the ones who are looking for stocks that are growing rapidly in terms of revenue,

even when a company is still losing money profit wise. Value investor are looking for bargains where they find stocks that have been beaten down by the market, and buy these

kind of stocks and hope they will rebound in the future.

When economy is doing well, good companies will do well. In an economy down turn, even the good companies will struggle.

This means to invest for the long term, not only you have to buy the right stocks, you have to know when to buy. There are many good books written on how to analyze a company and

read financial statements to invest successfully. Traders, on the other hand, does not rely on company fundamental data to make a trade although it does help if you are able to

combine technical analysis with fundamental analysis.

Conclusion

In a nutshell, following are some of the elements that are needed to get started in swing trading online.

- Have enough money before you get started. I would say a bare minimum of $3,000 is required. If you don't have $3,000, wait until you save $3,000. Do not borrow money to trade, because that will effect your mental attitude and ultimately crush your portfolio. The market has been around for hundreds of years, and it will still be here hundred years from now. There is no rush.

- Open an trading account with a stock broker online. You can use TDAmeritrade or Fidelity which are two reputable firms. They both have powerful trading platforms that allow you to trade on your desktop or your phone.

- Learn the necessary skills before you dive in. These skills including reading stock charts and recognizing patterns. Utilize technical indicators to help you find trade setups. Remember, you want to gain an edge over the other traders.

- Paper trade a few weeks and get a feel of how the market works before you trade with real money. See how the chart patterns and technical indicators work on real charts as well as against historical data.

- Lack of trading discipline is what crushes most traders. Paper trading is different than real trading because there is no money on the line. Even if you made successful trades when paper trading doesn't mean you will make money with real trades. Use paper trading as a way to practice and get familiarized with charts, but not as a way to boost your ego. Beginner traders usually do well paper trading, but losing money when they start real trading. This is not to imply that paper trading is useless, it is indeed very useful for beginners.

- Develop a trading method that works for you and set a stop loss that you are comfortable with for every trade. Once it is set, you must follow your rules whenever you put on a trade.

- Never double down on a trade no matter how attractive it looks. When you are in a losing position, there may be a desire for you to double down so that it makes your loss look smaller in terms of percentage loss. This is something that you should never do, because doubling down will ruin your discipline and portfolio. Successful traders do the exact opposite, they double up when they are in a winning trade.

- Keep a trading journal and record all your trades. This might seem trivial, but it is crucial for beginners to learn what they are doing right and wrong. Analyzing your own trades is the key for you to find flows in your trading system. This allows you to learn from your mistakes and grow as a trader.

|